FTX / NFT London

Hello and welcome to MadeMeThink! Once a week I send out this newsletter with curated content, events and examples that have sparked my interest. It's a review of my last 7-days in Web3, NFTs and the Metaverse. Want to follow my thoughts on a daily basis? Then connect with me via Linkedin and Twitter. This article is also available in German.

I've had an intense couple of weeks. I have been speaking a lot at conferences, companies and at the university. I was also at NFT London (some impressions below). And right now I'm sitting at the airport in Helsinki on my way home from Open Protocol, an invitation-only Web3 conference with 300 curated participants (more on this in the next newsletter).

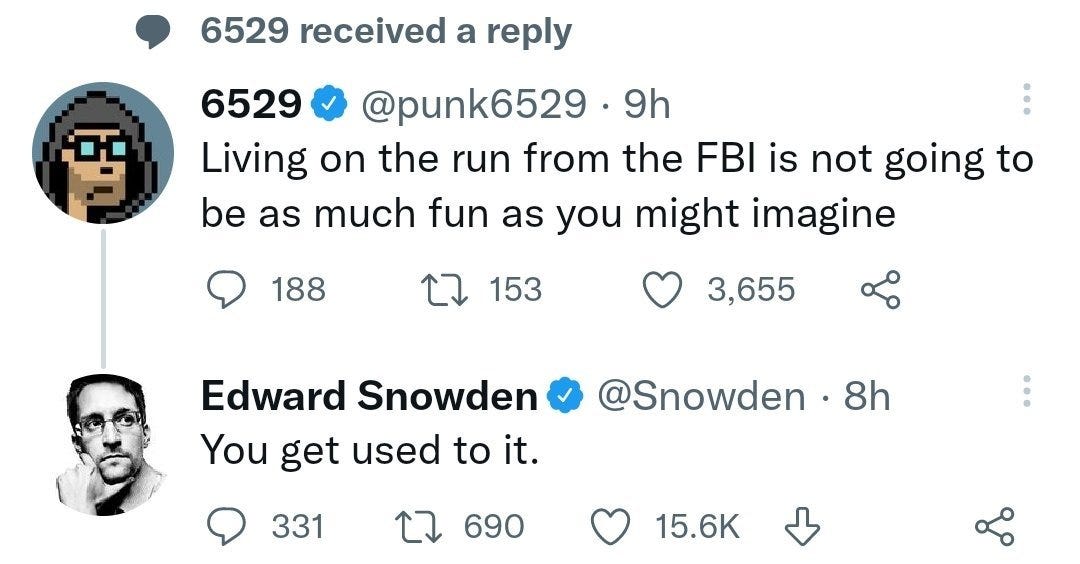

The crypto world is going through a turbulent time these days. After the spectacular failure of Terra in May 2022, one of the largest crypto exchanges, FTX, is filing for bankruptcy. FTX has apparently speculated with customer funds on a massive scale. 8 billion USD are missing (Source). Terra and FTX are stunning examples of megalomania, mismanagement and probably just plain fraud. But I don't want to repeat the whole FTX story now, as there are enough articles (see NYTimes, Coindesk, CNBC or Bored Founders Club) or videos (see Wall Street Journal or ColdFusion) on it (and Bankless wrote a good article why it needs more DeFi after FTX, not less). Crypto-Twitter is responding with countless memes on the situation (see below). However, FTX has once again shown that the mantra "Not your Keys, not your Coins" should be one of the crypto commandments. "Not your Keys, not your Coins" means that cryptocurrencies held in a central spot at crypto exchanges are not safe. That means everyone should manage their cryptocurrencies (/ their keys) themselves, preferably in a cold wallet, such as from Ledger.

For those interested in details, here is FTX's Chapter 11 bankruptcy filing. The introduction of the debtors’ CEO reads pretty adventurous:

„I have over 40 years of legal and restructuring experience. I have been the Chief Restructuring Officer or Chief Executive Officer in several of the largest corporate failures in history. I have supervised situations involving allegations of criminal activity and malfeasance (Enron) (…) Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

Zwar kein Meme, aber ein interessanter Dialog auf Twitter.

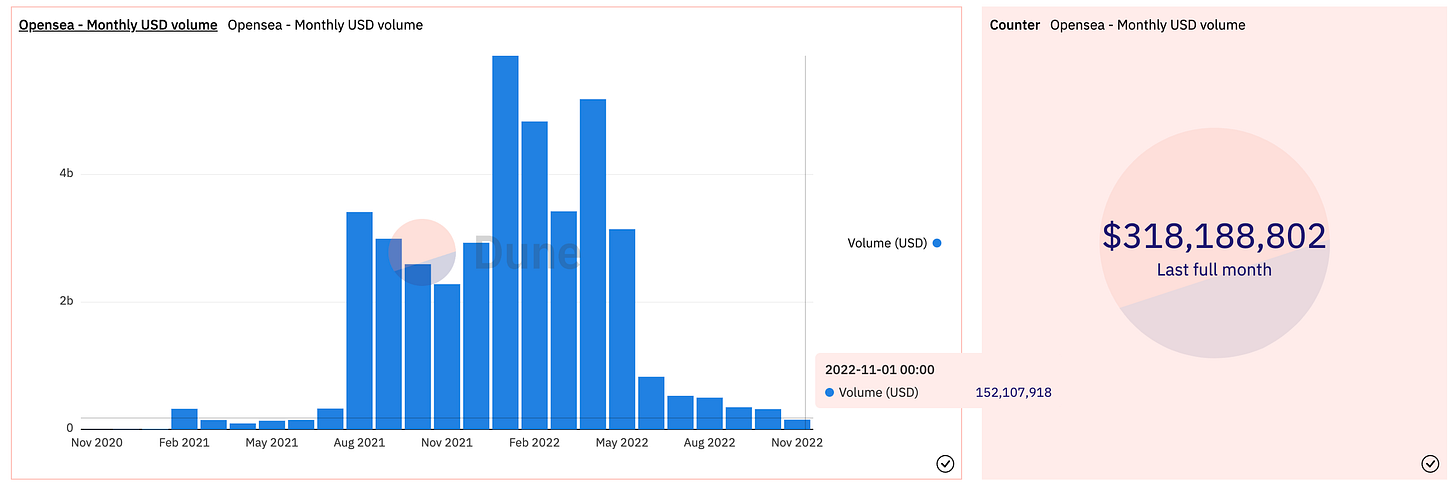

The FTX bankruptcy is affecting the entire crypto market, which has lost more than $250 billion in market capitalization over the past two weeks. Many NFT projects are also losing value. However, the downward trend had already been felt for some time. Trading volume on OpenSea, the world's largest marketplace for NFTs, has been declining for months (Source).

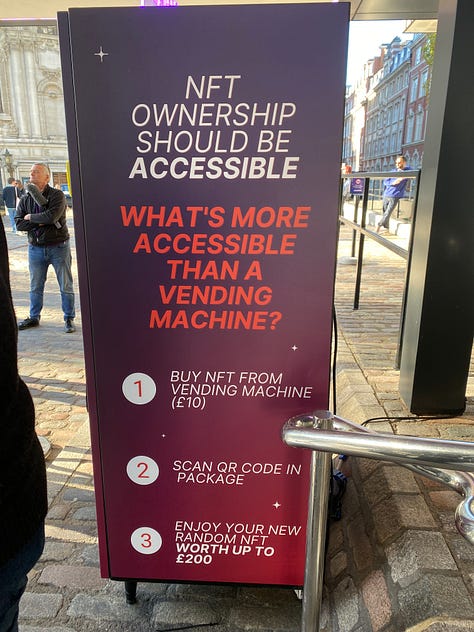

A correction in the NFT market was predictable and inevitable. Many projects lived only on hype and actually delivered little value to NFT holders. With prices falling, a lot of people are leaving the Web3/ NFT space. It has become quieter. At the NFT London, one of the largest conferences and meeting point of the NFT community, however, nothing of this was noticeable, the mood was good, although in a bull market the conference would certainly have been even more popular. Price developments for NFT projects were not really a topic in the conversations I had. It was about business ideas, technological developments and having a good time with other people from the community. For me it was very interesting to get to know new projects and their initiators or to learn what is happening in the Web3 space in different countries (for example see BFC's article about current Web3 projects in Poland). Many founders use the bear market to build new products. My co-founder Oliver and I are also working hard to build WalletFrens.xyz, a social network where you follow Web3 wallet addresses instead of people.

At the same time as NFT London, WebSummit was taking place in Lisbon. The last few years I've always been a visitor to WebSummit, but not this time. Bogusz from BFC, who was there (see his review of it here) sent me an interesting discussion with Cardano founder Charles Hoskinson from the Websummit to rewatch (starting at about minute 18):

In sum, though, I didn't regret attending NFT London (instead of WebSummit), quite the opposite. I had a really good time at the conference and I haven't been to London for so long that I completely forgot how beautiful the city is and how nice the people are. Attached are a few impressions from NFT London.

Disclaimer: The thoughts published in this publication are my personal opinions and should not be viewed as investment advice. I am not a financial expert. My specialty is entrepreneurship, innovation & marketing. Readers should always do their own research. I own various cryptocurrencies and NFTs, however in many cases it is for the sake of researching the field and gaining a deeper understanding of Web3, NFTs and the Metaverse and not for investment purposes.